Table Of Contents

Debentures Meaning

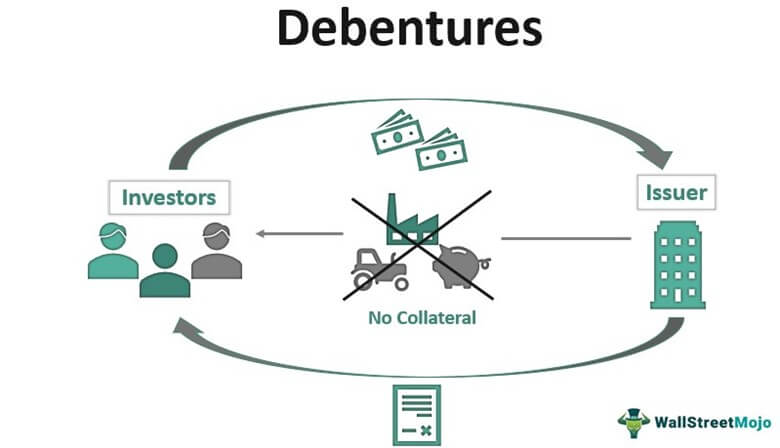

Debentures refer to long-term debt instruments issued by a government or corporation to meet its financial requirements. In return, investors are compensated with an interest income for being a creditor to the issuer.

They are usually an unsecured form of borrowing from the public and have a lengthy tenure, usually exceeding ten years.

Key Takeaways

- Debentures are unsecured bonds or debt instruments released by a government authority or company to finance its long-term, capital-intensive projects.

- It is a form of loan that the investors extend to the issuer or borrower without asking for any collateral by relying upon the latter's creditworthiness.

- Usually, the issuer pays a fixed interest at a coupon rate at regular intervals to compensate the investor.

- Also, the issuer can reimburse the borrowed amount in full on the maturity date or in fixed instalments payable at specific intervals.

Debentures Explained

A debenture is essentially a long-term loan that a corporate or government raises from the public for capital requirements. For example, a government raising funds to construct roads for the public. Debenture holders are the creditors of the issuing company, unlike a shareholder who is the owner.

Just like bondholders, debenture holders also earn an interest income for investing in the debt instrument. The coupon rates or interest rates are usually fixed unless when they are of the floating kind. A fixed rate of interest cushions against market fluctuations, making the investment less risky.

Debentures do not allow a claim over the issuer’s assets as they are largely unsecured debt instruments. The absence of collateral is offset by stable, low risk and better earnings. Also, a financially stable company with a reliable credit rating attracts investors as it reflects investment’s safety. Besides, with floating interest rates, earnings become better when rates improve.

Explanation of Debenture in Video

Features of Debentures

- Debentures are usually the unsecured form of bonds which are not backed by any asset or collateral. Instead, the investors consider the issuer's creditworthiness as a primary parameter for the purchase. Also, being a long-term instrument, their tenure usually lasts for 10 years and above.

- They have a fixed coupon rate, at which the investors receive interest at specific intervals, i.e., monthly, quarterly, half-yearly or yearly. Some investors also get accumulated interest on redemption. Earnings change if the interest rates are floating. Market fluctuations and economic conditions affect interest rates.

- The issuing company pays off the interest as an expense before paying the dividends. The interest is thus tax-deductible, bringing down the taxable income.

- Some companies issue debentures, which after a specified period, can be changed into equity stocks. This facilitates the investors to procure ownership in the organization and benefit from its earnings when its income is enhanced. In addition, the issuer enjoys low-cost borrowing since they offer a lower interest rate than non-covertibles.

- Repayments can be attained either in installments payable yearly or all at once. Thus, if the issuer pays off annual installments to the holders, it may do so by making a redemption reserve. Else, the issuer can repay the borrowed sum in a lump sum on the maturity date of the debt.

- They can be easily exchanged in the stock market, just like other securities. Thus, they are a flexible debt instrument.

- A real-world example is L&T Finance Ltd planning to issue secured, redeemable non-convertible debentures in 2012.

Types of Debentures

- Secured and non-secured: Apart from non-secured, companies also issue secured debentures in which investors hold a claim over the issuer's assets.

- Convertible or Non-convertible: Convertible ones can be transformed into equity shares after a particular period. Conversely, the non-convertible type is a debt instrument that cannot be converted into equity shares.

- Perpetual: These bonds don't have a maturity date, and the issuer need not redeem them. Instead, the issuer can opt to pay a regular interest for a lifelong period.

- Fixed Charge or Floating Charge: Under the fixed charge type, the unsecured bonds are locked at a predetermined or standard coupon rate throughout the holding period. Conversely, when the interest rates are floating, they vary with the changes in their benchmark rate.

Calculation Examples

Example 1

The formula for computing total interest paid by the issuer is as follows -

Interest Expense = Interest Rate/ 100 * Debt Amount

ABC Ltd. issued $240000 debentures at 5% coupon rate. Determine the interest paid.

- Interest Expense = 5/100 * 240000

- Interest Expense = $12000

Example 2

Whether the repayment methodology involves lump-sum or installment repayment, investors always try to find out the present value or the fair value of the investment. It helps in ascertaining its profitability. Therefore, let us calculate the debenture value when the repayment occurs in installments.

With each installment, the interest declines since the interests are calculated on an outstanding principal amount. When one deducts a repayment installment from the total debt, they are left with an outstanding principal amount. Therefore, we will need to calculate the present value of future interest payments and installments using a required rate of return (yield to maturity)

Debenture value= (I1+P1)/(1+r)^1 +(I2+P2)/(1+r)^2+……….(I3+P3)/(1+r)^n

= ∑ t=1to n (It+Pt )/ (1+r)t

Where,

- It= Interest payment for a particular period

- Pt=Principal payment for the same period

- r = Yield to maturity/ Required rate of return

An entity is issuing a debenture of 5 years, $1,000 to be remitted in equal installments at an 8% percent interest rate. The minimum required rate of return is 10%. Calculate the investment's present value.

A table depicting the discounted cash flows in each period is shown below:

Debentures in Accounting

The issue can happen at par, discount and premium, and they all call for a distinct journal entry. So let us look at them.

Issued at Par

When the issue is at face value, it is said to be issued at par. Thus, for example, if a $150 debenture is issued and redeemed at par, the journal entries in accounting are as follows:

Issued at Premium

When the issue is at a price surpassing the investment's face value, they are deemed to be issued at a premium. Thus, for example, if a $180 debenture is issued for $200 but redeemable at par, the journal entries in accounting are as follows:

Issued at Discount

When the issue is at a price lower than the investment's face value, it is issued at a discount. For example, if an $800 debenture is issued and redeemable for $750, the following will be the journal entries:

Advantages and Disadvantages

Debentures are beneficial to the issuing company as they don't risk the issuer's assets. Also, the ownership is not diluted, unlike shares. Interest paid is also tax-deductible. As for the investors, these debt instruments contain low risk and have regular returns. Moreover, in situations like corporate dissolution, they are repaid before the common shareholders.

Investors may encounter various uncertainties like inflationary risk or earn lower than the prevailing market when the interest rate is fixed. Additionally, floating rates could fall heavily, bringing down the interest income. In case the issuer fails to repay, investors won’t recover their money.

Bonds vs Debentures

Bonds and debentures are both a means of raising capital from the public by the government or companies and are very similar in nature. Both can be repaid in one go or multiple installments and come with fixed or floating interest rates.

Whenever a bond is unsecured, it could be a debenture. Besides, they are issued occasionally. As opposed to that, there are many reliable age-old bonds in the market from the government, such as US Treasury Bonds.